Borrowing Base 101: Managing Deferred Revenue

Written by Alex Ehrlich & Emily Vecchio

Asset-based lenders can ill-afford to be picky in today’s fiercely competitive lending environment. Adaptable lenders have been selectively financing companies with deferred revenue, while taking great care to carve out elements of deferred revenue from the borrowing base.

This article explores the basic principles of deferred revenue and the nuances of addressing such an item in preparing and managing a borrowing base.

Beware of Deferred Revenue Risks

The presence of deferred revenue in a company opens the risk of non-payment by a customer, which in turn exposes a lender to an over-extension of credit. From an accounting perspective, the revenue is deferred as the goods or services have not been delivered or rendered. Separately, the company may have invoiced the customer for the full amount of such goods or services and is awaiting receipt of payment. If the company is unable to deliver on its promises, the customer may have little recourse and will likely withhold payment.

Once Upon a Non-Payment

Consider a customer who is purchasing a security system, which includes camera hardware and monitoring software. Critical features of the security system include the ability to receive software updates as well as maintenance services over the life of the contract. The company may have recognized revenue and invoiced the customer after making the sale, but deferred revenue arises because the services are rendered over time. In the event services fail to be delivered, such as a wind-down scenario, the customer would be left with a security system operating on outdated software, along with a lack of on-going maintenance.

In the scenario above, the customer ends up being relegated to an unsecured creditor position with little to no recourse against the Company. It would not be unreasonable to expect the customer to withhold payment on the invoice, arguing that there is a breach of contract as the company did not live up to its obligations. Any advances by a lender against the receivable or invoice pertaining to deferred revenue would likely be uncollectible.

In contrast, there will be some within the customer base who are unaware of the situation or who are willing to compromise on payment to avoid any protracted legal or collections process. All these factors need to be considered in designing and implementing a borrowing base that offers availability to the company while limiting the risk of overextending credit by the lender because of deferred revenue.

Borrowing Base Part I – Initial Design & Onboarding

It would be advisable for lenders to prioritize addressing the issue within the borrowing base construct given the risks inherent in lending to companies with deferred revenue. Carving out the deferred revenue and offsetting the amount against outstanding accounts receivables in the borrowing base is a straightforward method of addressing the issue directly. The discerning borrower may argue for an offset limited specifically against receivables associated with such deferred revenue on a customer level. This latter method, while being more precise, requires a deeper understanding of the books and records in order to implement. Both these methods can be explained rationally to the borrower at the onboarding stage. This calculation ultimately serves as a proxy for the amount a lender can expect to collect in a liquidation scenario.

Borrowing Base Part II – On-going Risk Mitigation

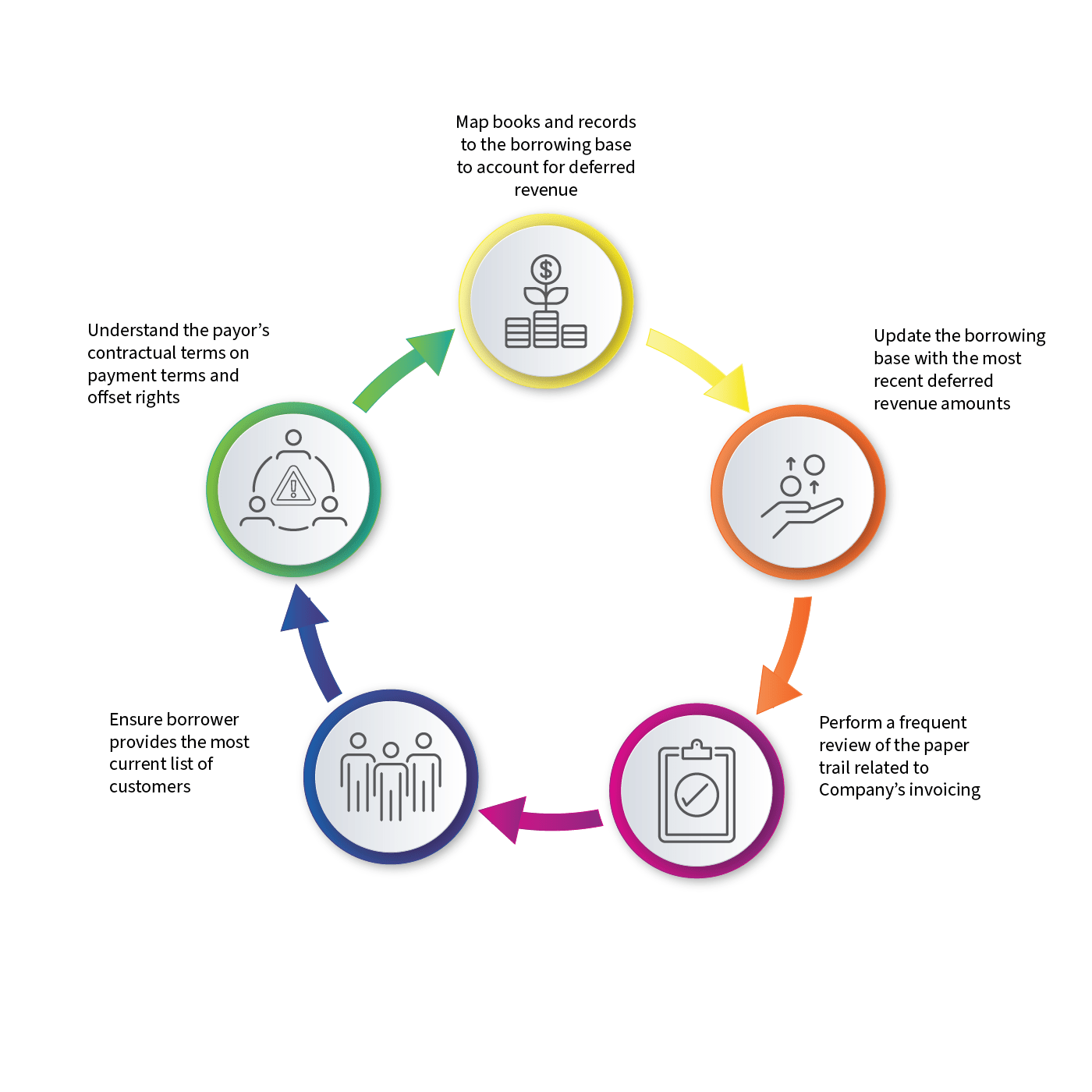

It is also important to take various measures to mitigate the risk on an ongoing basis after carving out deferred revenue from the borrowing base. In particular, lenders should consider the following due diligence tools in monitoring the borrowing base:

- Understand the payor’s contractual terms on payment terms and offset rights

- Map books and records to the borrowing base to account for deferred revenue

- Update the borrowing base with the most recent deferred revenue amounts

- Perform a frequent review of the paper trail related to invoicing activity

- Ensure borrower provides the most current list of customers

Reasonable Approach

Broaching the topic of offsetting deferred revenue in a borrowing base is generally a delicate conversation with the borrower. However, the possibility of non-payment is apparent enough that it would be difficult for a lender to ignore the risk completely. The direct relationship between the offset and the deferred revenue amounts should be sufficiently clear for the borrower to appreciate the risk to the lender. An implemented offset should not exceed the open accounts receivable balance, nor will it exceed the value of the deferred revenue. From the borrower’s perspective, this should be viewed as a reasonable approach in support of the need to carve out deferred revenue and addressing it in the form of a reserve in the borrowing base.

Understanding the risks posed by deferred revenue will help lenders pinpoint the areas of a borrowing base which require attention to properly structure and monitor a credit facility. Lenders can successfully navigate inherent risks through a combination of rigorous onboarding and meticulous post-closing collateral monitoring process. This approach ultimately benefits the lender who is equipped with the tools necessary to confidently execute a financing while minimizing the exposure to risks brought on by deferred revenue.

This article is for informational purposes only and does not constitute professional advice. Investments always have the potential for loss. FGI, including its affiliates, makes no warranties about the accuracy or the completeness of this information and disclaims any liability (including direct, indirect or consequential loss or damage) related to the materials. Please consult your financial professional for advice relating to your circumstances and refer to our full terms and conditions.